Biitland.com Stablecoins Guide 2025 | Types, Benefits & Comparison

The crypto market is well-known for its high volatility, where prices can swing dramatically within short periods. While this can lead to significant gains, it also introduces serious risks—particularly for those looking for a stable store of value or a consistent medium of exchange. This is where stablecoins play a vital role. Backed by real-world assets or algorithms to maintain a steady value, stablecoins offer a balance between the innovative utility of blockchain and the price stability that bitcoin and other crypto assets often lack.

Biitland.com introduces a unique breed of stablecoins that prioritize transparency, decentralization, and real-world usability. Let’s explore how their system works—and why it matters more than ever in 2025.

What Are Biitland.com Stablecoins?

Biitland stablecoins are blockchain-based digital currencies designed to maintain a consistent value, usually pegged to the USD or other stable assets. These coins offer a secure way to engage in payments, savings, and decentralized applications (DeFi) without worrying about sudden price volatility. For users exploring trading insights in the DeFi space, our DEX Trading Analytics page provides in-depth tools and data to support smarter decisions.

Related Queries

Q: What makes Biitland stablecoins different from USDT or USDC?

A: Unlike USDT and USDC, Biitland uses a hybrid model combining fiat and algorithmic elements, offering more transparency and decentralization.

Q: Is Biitland.com a safe platform to use stablecoins?

A: Yes, Biitland is KYC/AML compliant, conducts regular audits, and employs multisig wallets for added security.

Q: What are the benefits of stablecoins over Bitcoin?

A: Stablecoins provide price stability, making them ideal for day-to-day use, while Bitcoin is better suited for long-term investment.

Key Features of Biitland.com Stablecoins

Biitland’s architecture emphasizes decentralization, automation, and transparency. Every token is issued and managed through smart contracts and backed by reserves or algorithmic protocols, with real-time updates available to users. If you’re interested in exploring how such blockchain principles are applied in gaming, check out the wide range of options at GoCryptoBet Casino Games.

Related Queries

Q: Do Biitland stablecoins use blockchain?

A: Yes, they are built on Ethereum and BNB Smart Chain, using smart contracts for automation.

Q: How does Biitland ensure price stability?

A: Through oracle pricing, reserve audits, and self-balancing supply algorithms.

Price Stability Mechanisms

Biitland employs a combination of fiat reserves and algorithmic supply control to ensure its stablecoins remain closely pegged to their target values.

Smart Contract Automation

All issuance and redemptions are controlled by smart contracts, ensuring trustless and autonomous execution.

Transparency & Audits

Biitland.com conducts regular third-party audits and publishes real-time proof-of-reserves, aligning with EEAT (Expertise, Authoritativeness, Trustworthiness) standards.

Low-Cost, High-Speed Transactions

Operating on efficient blockchain protocols allows users to send funds quickly with minimal fees.

Cross-Border Accessibility

Accessible globally with no need for a bank account—ideal for international payments and remittances.

Types of Biitland Stablecoins

Biitland offers a variety of stablecoin models:

- Fiat-backed: Directly backed by cash reserves

- Crypto-backed: Secured using ETH or BTC

- Algorithmic: Uses on-chain supply balancing

- Hybrid: Mix of fiat + smart contract-driven control

Related Queries

Q: Which type of stablecoin is safest?

A: Fiat-backed stablecoins are traditionally safest, but Biitland’s hybrid approach balances safety and decentralization.

Q: What’s the difference between algorithmic and fiat-backed stablecoins?

A: Fiat-backed stablecoins rely on actual reserves. Algorithmic ones adjust supply via smart contracts without holding reserves.

How Biitland.com Maintains Price Stability

Stablecoins need mechanisms to prevent “de-pegging.” Biitland achieves this with a layered system of overcollateralization, dynamic supply control, and oracle-driven pricing feeds. The system reacts instantly to market changes. Learn how similar financial principles apply to traditional assets in our guide on the best stocks to buy.

- Overcollateralization: Backed by more assets than the coins issued.

- Price Oracles: Pulls real-time market data from trusted oracle networks.

- Algorithmic Adjustments: Automatically increases or decreases supply based on demand.

- Multi-Sig Governance: Controlled by a decentralized network of verified nodes.

Related Queries

Q: Can Biitland stablecoins lose their peg?

A: Rarely. They use multiple stability mechanisms, but like any asset, extreme market conditions could affect them.

Q: How does algorithmic stabilization work?

A: It adjusts token supply (minting or burning) to counteract price fluctuations, keeping the coin close to its peg.

Technology Behind Biitland Stablecoins

Smart contracts are at the core of Biitland’s system. These contracts are deployed on secure and audited blockchains, handling issuance, redemptions, and transfers with no human interference. This technology also plays a crucial role in platforms like crypto betting on GoCryptoBet, ensuring transparency and automation in every transaction.

Related Queries

Q: Is Biitland stablecoin built on Ethereum?

A: Yes, and it also supports BNB Smart Chain for scalability and lower fees.

Q: Are their smart contracts audited?

A: Yes, third-party audits are conducted quarterly and are available to the public.

Security and Compliance Measures

Biitland emphasizes security through encryption, multi-sig wallets, and offline cold storage. Its compliance with KYC and AML rules also ensures global accessibility and legal safety, similar to platforms that guide users on how to bet with Bitcoin on GoCryptoBet.com in 2025.

- Smart Contract Audits: Conducted quarterly by independent firms.

- AML/KYC Procedures: Compliant with international standards to prevent misuse.

- Cold Wallet Storage: Majority of reserves are stored offline.

- Insurance Coverage: Coverage for loss from smart contract failures or custodial breaches.

Related Queries

Q: Are Biitland stablecoins legal?

A: Yes, Biitland operates under global compliance regulations including KYC and AML.

Q: Do they require KYC to use?

A: Yes, users must verify their identity before accessing advanced features like fiat conversions or higher limits.

Benefits of Using Biitland.com Stablecoins

Stablecoins let users save, spend, and send funds without worrying about volatility. Biitland stablecoins go further by offering DeFi integrations and real-time audit transparency, aligning with innovative platforms like GoCryptoBet.com for secure and seamless betting.

- Hedge Against Volatility: Maintain purchasing power in volatile markets.

- Ideal for DeFi Use: Integrates with lending, staking, and yield farming platforms.

- Low Remittance Fees: Send money globally at a fraction of the cost of traditional systems.

- Safe for E-Commerce: Enable fast, secure, and chargeback-free payments.

How Stablecoins Power the Future of Decentralized Finance (DeFi)

Stablecoins have become a cornerstone of the Decentralized Finance (DeFi) ecosystem, offering a reliable and secure unit of account for users engaging in crypto-based transactions. Unlike traditional cryptocurrencies that often face high volatility, stablecoins are pegged to fiat currencies like the USD, ensuring price stability across DeFi platforms.

By eliminating the need for traditional financial intermediaries, stablecoins enable direct peer-to-peer transactions, giving users complete control over their digital assets. This aligns perfectly with the core principle of DeFi—decentralization—while maintaining efficiency, transparency, and accessibility.

Key Benefits of Stablecoins for Traders and Investors

For crypto traders and investors, stablecoins offer a crucial safety net during market downturns. When the market becomes unstable, converting assets into stablecoins helps preserve capital and reduce exposure to volatility.

Here are some top advantages of using stablecoins in DeFi:

- Risk Mitigation: Protects portfolios during market corrections

- High Liquidity: Enables fast access to funds across platforms

- Quick Transfers: Facilitates near-instant and low-cost transactions

- Interoperability: Easily moves funds between DeFi protocols and exchanges

- Strategic Flexibility: Let’s traders quickly switch between risk and stability

Why Stablecoins Matter in DeFi Ecosystem

Whether you’re lending, borrowing, staking, or yield farming, stablecoins are essential for executing these functions without worrying about sudden price drops. They not only enhance financial freedom but also boost the scalability and sustainability of the DeFi space.

Related Queries

Q: Can I earn interest using Biitland stablecoins?

A: Yes, you can stake or lend them through DeFi protocols partnered with Biitland.

Q: Are they good for sending money internationally?

A: Absolutely. They allow fast, cheap cross-border transfers without needing banks.

Real-World Use Cases

From online shopping to freelancer payments, Biitland stablecoins are usable anywhere digital payments are accepted. They’re also ideal for cross-border remittances, offering faster and cheaper alternatives to traditional banking.

- E-Commerce Payments: Enable faster checkout with less fraud.

- Cross-Border Transfers: Especially valuable for freelancers and remote teams.

- Stable Store of Value: Used by crypto users in unstable economies.

- Trading & Arbitrage: Take advantage of price gaps across exchanges safely.

Related Queries

Q: Can I use Biitland stablecoins to shop online?

A: Yes, many merchants and platforms accept them directly or via plugins.

Q: How do freelancers benefit from stablecoins?

A: Freelancers can receive global payments instantly with lower fees and no bank involvement.

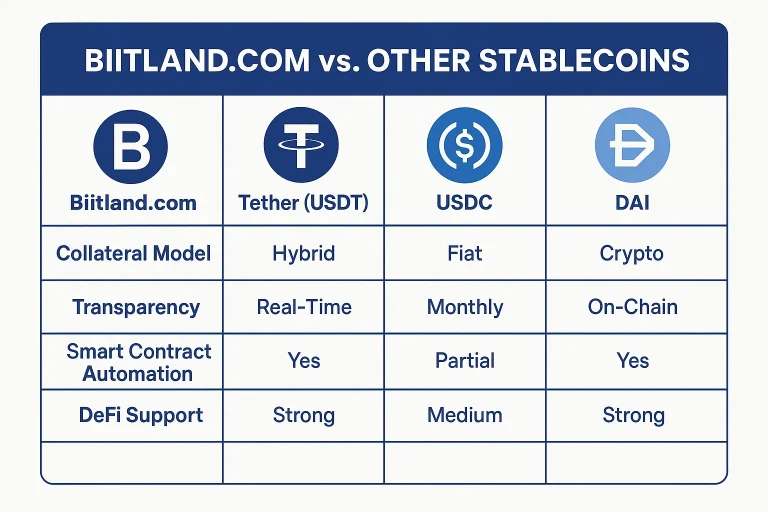

Biitland.com vs. Other Stablecoins

Biitland’s real-time transparency, hybrid model, and strong DeFi compatibility give it an edge over older centralized options like Tether or USDC.

| Feature | Biitland.com | USDT | USDC | DAI |

|---|---|---|---|---|

| Collateral Type | Hybrid | Fiat | Fiat | Crypto |

| Transparency | Real-time | Monthly | Monthly | On-chain |

| Decentralization Level | Medium | Low | Medium | High |

| Use in DeFi | High | Medium | High | High |

Related Queries

Q: Is Biitland better than USDT?

A: Biitland offers better decentralization and real-time proof of reserves compared to USDT’s limited transparency.

Q: How transparent is Biitland.com compared to other stablecoins?

A: It publishes real-time reserve data and allows public verification through blockchain explorers.

Risks and Challenges

Even well-designed systems have risks: smart contract bugs, market crashes, or regulatory crackdowns. Biitland minimizes these through audits, insurance funds, and a strong governance community.

While stablecoins solve many problems, they also carry certain risks:

- Algorithmic Risks: If poorly designed, they may lose their peg.

- Regulatory Scrutiny: Governments may impose restrictions.

- Smart Contract Vulnerabilities: Bugs can be exploited without proper auditing.

Biitland mitigates these through redundant systems, external audits, and decentralized governance.

Related Queries

Q: What happens if Biitland stablecoin gets hacked?

A: User funds are insured against smart contract failures, and emergency protocols are in place.

Q: Are algorithmic stablecoins risky?

A: Yes, if not well-managed. Biitland combines algorithmic methods with real reserves to reduce this risk.

Community & Governance at Biitland

Unlike centralized providers, Biitland is governed by its users via a DAO (Decentralized Autonomous Organization). Token holders can vote on changes and policy decisions.

Related Queries

Q: Who controls Biitland stablecoins?

A: Governance token holders, not a central authority, control upgrades and monetary policy.

Q: What is the Biitland DAO?

A: It’s a decentralized voting system that allows users to influence development and policy.

How to Get Started with Biitland.com Stablecoins

Getting started is easy:

- Go to Biitland.com

- Create an account

- Complete KYC

- Connect your wallet

- Buy or transfer stablecoins

- Use, stake, or send them instantly

Related Queries

Q: How to buy Biitland stablecoins?

A: Through DEXs, CEXs, or directly on Biitland’s platform.

Q: Which wallets support Biitland stablecoins?

A: MetaMask, Trust Wallet, Coinbase Wallet, and other EVM-compatible wallets.

How to Use Stablecoins: Step-by-Step Guide for Beginners

Stablecoins are increasingly becoming a go-to asset for investors and everyday crypto users. Here’s a clear, step-by-step guide to help you apply stablecoins effectively in your financial strategy:

✅ Step-by-Step Process

- Select a Reliable Stablecoin

Choose a stablecoin backed by transparent reserves and a strong track record. Popular options include USDT, USDC, and DAI. Always verify the issuer’s credibility before investing. - Add Stablecoins to Your Portfolio

Use stablecoins to diversify your crypto portfolio. Allocating a portion of your assets to stablecoins helps reduce exposure to market volatility and protects your overall investment value. - Use Stablecoins for Everyday Transactions: Benefit from low fees and fast transaction speeds by using stablecoins for trading, transferring funds across wallets or platforms, and making purchases on decentralized apps (dApps).

Common Mistakes to Avoid When Using Stablecoins

- Skipping Research on Issuers:

Always review the transparency and reserve policies of the stablecoin provider to avoid hidden risks. - Putting All Your Funds in One Stablecoin:

Avoid concentrating your holdings in a single stablecoin. Spread your assets across different stablecoins to mitigate risk from potential insolvency. - Ignoring Market Movements:

Even though stablecoins aim to hold their value, keep an eye on market news and project updates to adjust your strategy when necessary.

Frequently Asked Questions (FAQ)

Q: Are Biitland stablecoins pegged 1:1 with USD?

A: Some are, while others follow algorithmic or hybrid models.

Q: Can I use Biitland in DeFi apps?

A: Yes. They’re fully compatible with major DeFi platforms.

Q: How often are Biitland reserves audited?

A: Every quarter, and results are published on their official site.

Q: Are Biitland stablecoins regulated?

A: Yes, they comply with global crypto regulation standards.

Realted Post

Conclusion: Are Biitland Stablecoins the Future of Crypto?

Biitland.com combines decentralization, compliance, and technological sophistication in its stablecoin system. With multi-layered stability mechanisms, full transparency, and real-world applications, it’s shaping the next generation of financial tools.

👉 Explore the ecosystem at Biitland.com or start using Biitland Stablecoins today!